mississippi income tax rate

3 on the next 3000 of taxable income. Income Tax Bracket Tax Rate 2020.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Outlook for the 2021 Mississippi income tax rate is to remain unchanged.

. The Mississippi corporate tax rate is changing. Mississippi has three marginal tax brackets ranging from 3 the lowest Mississippi tax bracket to 5 the highest Mississippi tax bracket. Currently the corporate income tax rates are 3 percent for the first 5000 4 percent for the next 5000 and 5 percent on anything beyond 10000.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Mississippis income tax brackets were last changed four years prior to 2020 for tax year 2016 and the tax rates have not been changed since at least 2001. Mississippi income tax rate and tax brackets shown in the table below are based on income earned between January 1 2020 through December 31 2020.

Wages are taxed at normal rates and your marginal state tax rate is 00. Mississippi sales tax rates. 4 on the next 5000 of taxable income.

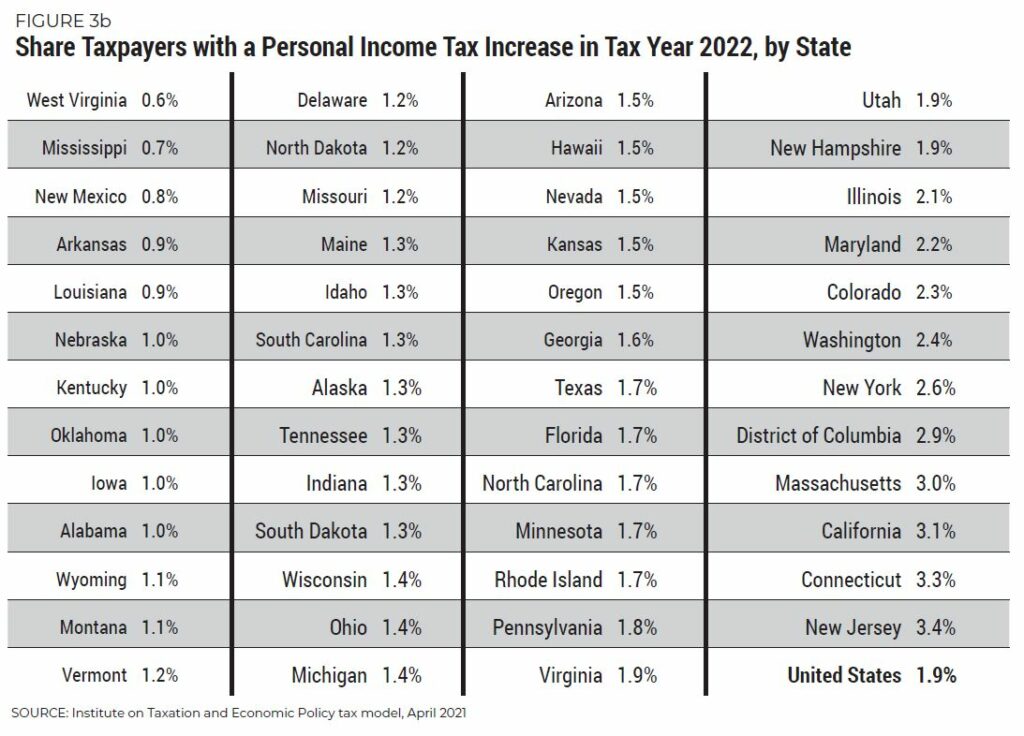

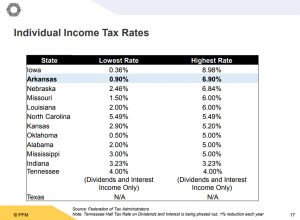

An individual income tax or personal income tax is levied on the wages salaries investments or other forms of income an individual or household earns. Ad Compare Your 2022 Tax Bracket vs. When the plan is fully phased in Gunn said Mississippi will have the 5 th lowest marginal rate of the 41 states with a personal income tax.

Does Mississippi have a minimum corporate income tax. Find Millions Of Results Here. How to Calculate 2022 Mississippi State Income Tax by Using State Income Tax Table.

0 on the first 3000 of taxable income. Social Security income is not taxed. The personal income tax which has a top rate of 5 is slightly lower than the national average for state income taxes.

2022 Mississippi Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. How do I compute the income tax due. In subsequent years the Magnolia State would effectively impose a flat tax of 5 percent on all taxable income over.

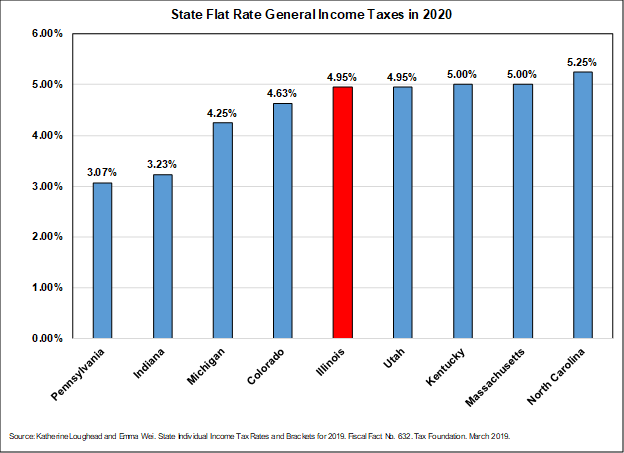

But if legislators take no action the tax rate will remain at 4. Lobbying groups like Empower Mississippi say a lower flat tax rate would make the state more competitive. Mississippi has a graduated tax rate.

Reduce state income tax revenue by 525 million a year starting in 2026. These rates are the same for individuals and businesses. Get Ms In Tax.

Details on how to only prepare and print a Mississippi 2021 Tax Return. At the end of the four years there would be a higher threshold before any taxes are owed. Gunn said he anticipates the governor will sign the legislation and like him continue to work to eliminate the income tax.

Created with Highcharts 607. Ad Get Ms In Tax. Your average tax rate is.

Check the 2022 Mississippi state tax rate and the rules to calculate state income tax. According to the Mississippi Department of Revenue people with incomes of at least 100000 a year make up 14 of those who pay state income tax and their payments bring in 56 of the income tax. Give Mississippi when fully implemented the fifth-lowest marginal tax rate for states that have income tax although other states are also considering cuts or elimination.

Harkins said the tax cut would reduce state revenue by 185. Find your pretax deductions including 401K flexible account contributions. In general Mississippi businesses are subject to.

Withdrawals from retirement accounts are not taxed. 3 on the next 2000 of taxable income. The graduated income tax rate is.

If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. However the statewide sales tax of 7 is slightly above the national average. Imposes a progressive income tax where rates increase with income.

Quick Guide to Mississippi Retirement Income Taxes. Mississippi has a graduated tax rate. 5 on all taxable income over 10000.

California tops the list with the highest income tax rates in the countryits highest tax rate is 123 but it also implements an additional tax on those with income of 1 million or more which makes its highest actual tax rate 133. Find Quick Results from Multiple Sources. Mississippi is very tax-friendly toward retirees.

When coupled with the 3 percent marginal rate repeal which was fully eliminated at the start of 2022 the Senates bill would result in Mississippi levying no tax on the first 100000 of taxable income by calendar year 2026. Mississippi Income Tax Forms. This tool compares the tax brackets for single individuals in each state.

In the next three years rates that apply to income over 10000 would be reduced from 5 to 4. Mississippi Single Income Tax Brackets. Find your income exemptions.

4 on the next 5000 of taxable income. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Mississippis sales tax rate.

Mississippi has a graduated tax rate. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Mississippi residents have to pay a sales tax on goods and services.

Mississippi has a graduated income tax rate and is computed as follows. Your 2021 Tax Bracket to See Whats Been Adjusted. After the first year the tax-free income levels would be 18300 for a single person and 36600 for a married couple lawmakers said.

There is no tax schedule for Mississippi income taxes. There is no tax schedule for Mississippi income taxes. Use this tool to compare the state income taxes in Louisiana and Mississippi or any other pair of states.

Discover Helpful Information and Resources on Taxes From AARP. Mississippi Income Tax Calculator 2021. 0 on the first 2000 of taxable income.

The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. For more information about the income tax in these states visit the. Find your gross income.

These rates are the same for individuals and businesses. Mississippi State Income Tax Forms for Tax Year 2021 Jan. Flat rate on all taxable income in the state.

5 on all taxable income over 10000. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Detailed Mississippi state income tax rates and brackets are available on this page.

Historical Mississippi Tax Policy Information Ballotpedia

South Carolina S Uncompetitive Income Tax The South Carolina Policy Council

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Strengthening Mississippi S Income Tax Hope Policy Institute

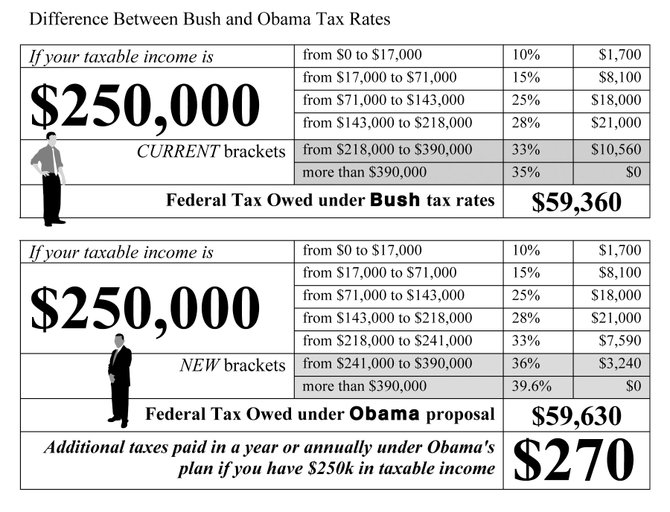

Taxes Obama Vs Bush Rates Jackson Free Press Jackson Ms

Individual Income Tax Structures In Selected States The Civic Federation

Tax Rates Exemptions Deductions Dor

Mississippi Income Tax Brackets 2020

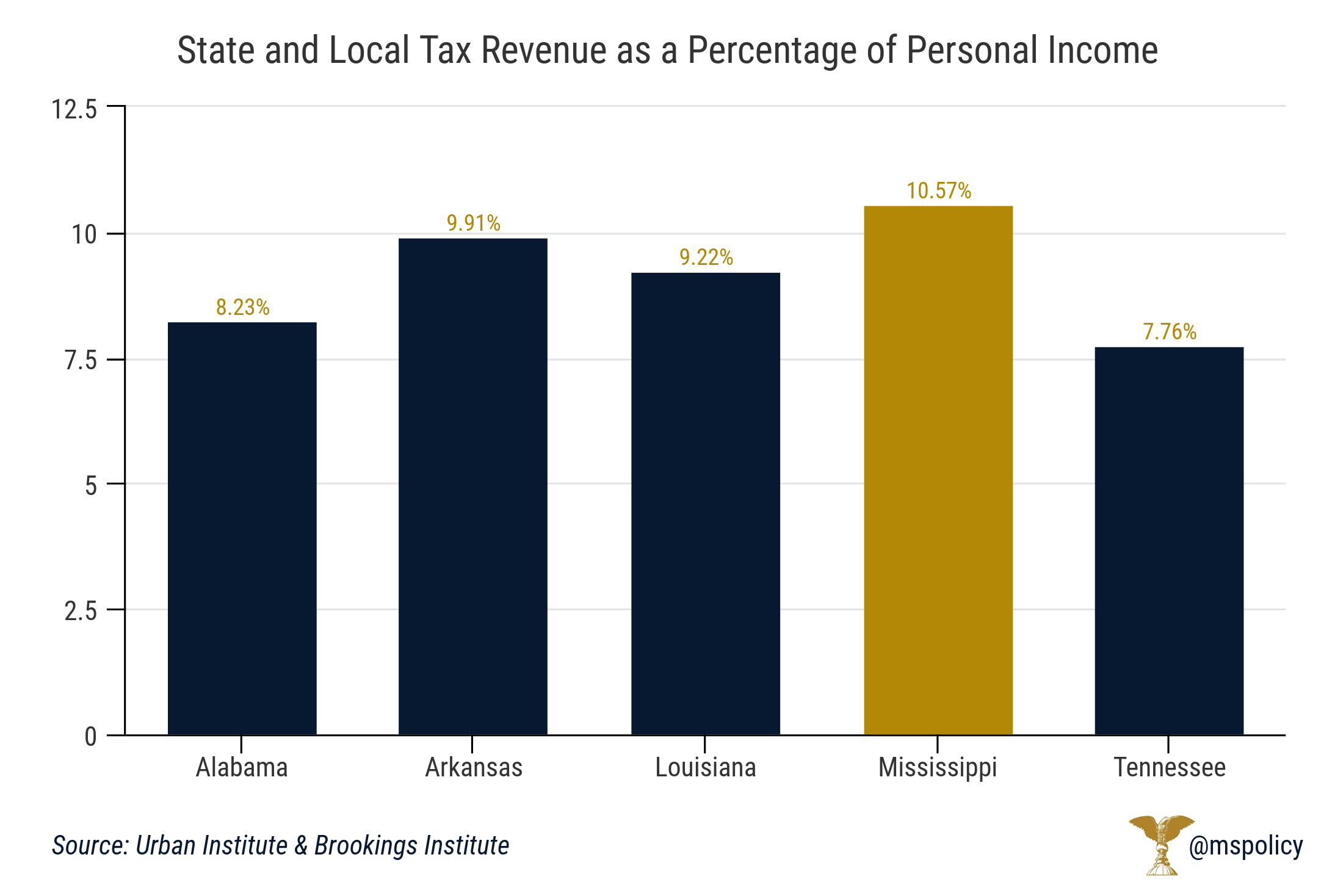

Mississippians Have Among The Highest Tax Burdens Mississippi Center For Public Policy

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Mississippi Tax Rate H R Block

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

The Most And Least Tax Friendly Us States

Tax Rates Exemptions Deductions Dor

Mississippi Tax Forms And Instructions For 2021 Form 80 105

Mississippi Tax Rate H R Block

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation